The Things You Need To Learn About Home Mortgages

Content written by-Hammond McQueenAre you planning to buy a new home? Or is your current mortgage too high thanks to the slumping economy? Do you need to refinance or take on a second mortgage to complete work on your home? No matter what reason you have for seeking a mortgage, this article has what you need to know.

Start preparing for your home mortgage well in advance of applying for it. Get your budget completed and your financial documents in hand. You should have a healthy savings account and any debt that you have must be manageable. If these things are something you wait on, you might not get approved for your home.

Know your credit score before beginning to shop for a home mortgage. If your credit score is low, it can negatively affect the interest rate offered. By understanding your credit score, you can help ensure that you get a fair interest rate. Most lenders require a credit score of at least 680 for approval.

It is likely that your mortgage lender will require a down payment. It's rare these days that qualifying for a mortgage does not require a down payment. Prior to applying for a loan, ask what the down payment amount will be.

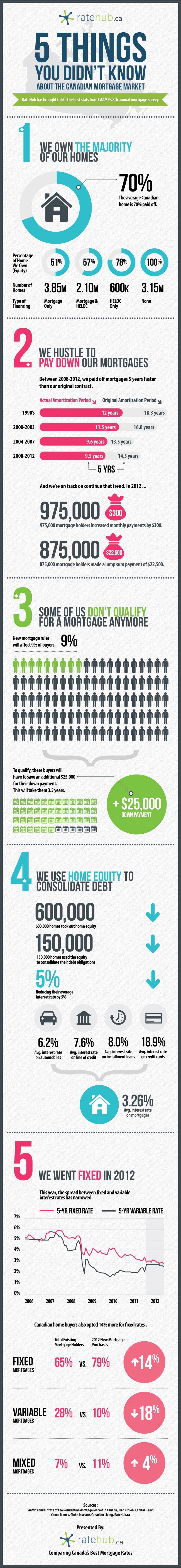

If your mortgage spans 30 years, think about chipping an additional monthly payment. The extra amount will be put toward the principal amount. This will help you pay your loan even faster and reduce your total interest amount.

A solid work history is helpful. Many lenders insist that you show them two work years that are steady in order to approve your loan. Multiple job changes can also cause disqualification. You never want to quit your job during the loan application process.

Know that Good Faith estimates are not binding. These estimates are designed to give you a good idea of what your mortgage will cost. It should include title insurance, points, and appraisal fees. Although you can use this information to figure out a budget, lenders are not required to give you a mortgage based on that estimate.

Pay off your mortgage sooner by scheduling bi-weekly payments instead of monthly payments. visit the next internet site will end up making several extra payments per year and decrease the amount you pay in interest over the life of the loan. This bi-weekly payment can be automatically deducted from your bank account to make it easy and convenient.

Monitor interest rates before signing with a mortgage lender. If the interest rates have been dropping recently, it may be worth holding off with the mortgage loan for a few months to see if you get a better rate. Yes, it's a gamble, but it has the potential to save a lot of money over the life of the loan.

Know your mortgage interest rate type. When you are obtaining home financing you should understand how the interest is calculated. Your rate could be fixed or it could be adjustable. With fixed interest rates, your payment will usually not change. Adjustable rates vary depending on the flow of the market and are variable.

Check with your local Better Business Bureau before giving personal information to any lender. Unfortunately, there are predatory lenders out there that are only out to steal your identity. By checking with your BBB, you can ensure that you are only giving your information to a legitimate home mortgage lender.

Make sure your credit looks good in advance of trying to secure a mortgage. Today's lenders are looking for a borrower with great credit. This is so that they feel comfortable about the risk they are taking. Tidy up your credit before you apply.

You must be demonstrably responsible to get a home mortgage. This means you have to have a good job that pays for your lifestyle with money to spare. Not only that, you must have been on the job for a couple of years or more, and you must be a good employee. The home mortgage company is entering into a long term relationship with you, and they want to know that you are ready to commit seriously!

Do not take out a mortgage loan in order to buy the most expensive home on the block. While that may seem like a good idea, it can have a negative impact on your financial future. Since home values are calculated based on all of the homes around them, which means that later on you may have a hard time selling it for its full value.

Ask around about mortgage financing. You may be surprised at the leads you can generate by simply talking to people. Ask your co-workers, friends, and family about their mortgage companies and experiences. They will often lead you to resources that you would not have been able to find on your own.

Remember that https://www.businessinsider.com/personal-finance/best-banks takes time to get a mortgage closed; therefore, it is important to include enough time in the sales contract for the loan to close. Although it may be tempting to say the deal will be closed within 30 days, it is best to use a 60 or 90 day timeframe.

You may want to purchase your dream home, but finding a home that's more affordable will help you get approved for a home mortgage. Instead of that million-dollar home in the ritzy neighborhood, focus more on middle-of-the-road homes that aren't that expensive. Getting a home is the important thing; living like Donald Trump isn't nearly as important as having a roof over your head.

Getting a mortgage without much of a credit history is more difficult and requires you to provide alternative information to get your loan. Keep payment records for up to a year. If you have weak credit, then having proof that you've paid your bills on time will show the lenders your credit worthiness.

During the process of obtaining a mortgage loan, submit any requested documents to your mortgage broker or lender as soon as possible. Taking your time to respond to your lender can delay the date of the closing. Delaying the closing date can put you at risk of losing the rate you have locked-in.

The last thing you want to do is to sign the paper for your mortgage and days or months later find out you made a really bad mistake. Instead, you want to be confident that you have made a really good decision. Move forward with the tips that have been provided to you and choose wisely.